In the realm of investing, there’s a certain pedigree that screams stability, resilience, and a touch of old-world financial charm. I’m talking about the European Dividend Aristocrats, a league of companies that are the financial equivalent of a sturdy oak in a storm-ridden market. These aren’t your flashy tech startups that burn bright and fizzle out; these are the time-tested titans that have been doling out dividends like clockwork, come rain or recession.

Learning about European Dividend Aristocrats

By reading this article, you will learn:

– What European Dividend Aristocrats are and how to invest in them.

– The list of European Dividend Aristocrats by country.

– Information about European Dividend Aristocrats ETFs.

What are European Dividend Aristocrats?

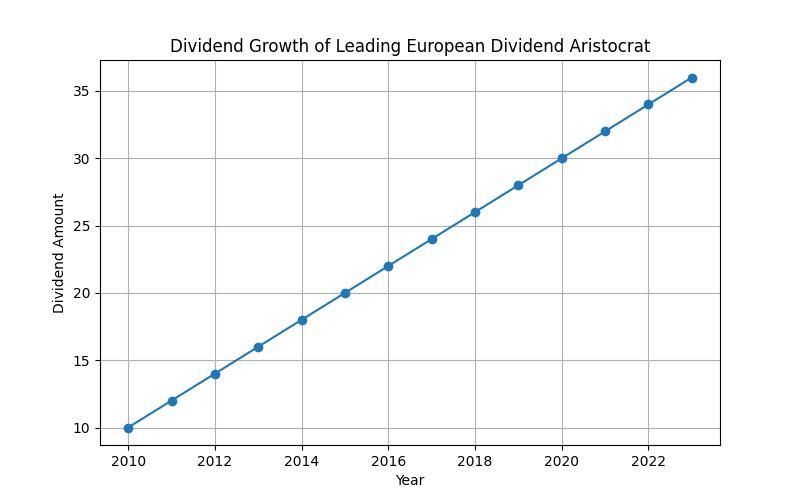

Let’s set the stage with a bit of clarity: European Dividend Aristocrats are not your run-of-the-mill dividend-paying companies. These are the crème de la crème of the European stock market; companies that have not only paid but also increased their dividends for at least 25 consecutive years. It’s the kind of consistency that would make a Swiss watch blush.

I remember the first time I stumbled upon the concept of Dividend Aristocrats. It was a cold, dreary day in my cramped home office, and the markets were as unpredictable as a game of roulette. That’s when I discovered the warmth of these aristocratic dividendscompanies with a long history of payout increases, regardless of the economic climate.

Insider Tip:

Always look for a pattern of dividend growth, not just high yields. A high yield on a shaky foundation is like a siren’s songenticing but dangerous.

How to Invest in European Dividend Aristocrats

Investing in European Dividend Aristocrats is akin to buying a piece of Europe’s economic heritage. But it’s not just about throwing your Euros at any company with a decent yield. It’s about due diligence, understanding the business models, and recognizing their ability to withstand economic pressures.

You can cherry-pick stocks from the list of European Dividend Aristocrats, or you can opt for a simpler route: Exchange-Traded Funds (ETFs) that track the performance of these aristocratic companies. ETFs offer diversification and lower risks, as you’re not putting all your eggs in one basket.

For more details on selecting the best ETFs, check out this comprehensive guide.

European Dividend Aristocrats List

Now, let’s journey across the European landscape and unveil the dividend royalty from various countries. This list isn’t just a collection of names; it’s a testament to the enduring power of solid business practices and shareholder value.

Austria

In the heart of Europe, Austrian companies stand tall with their dividend traditions. Voestalpine AG, for instance, has been a beacon of consistency in the steel industry, a sector not usually known for its stability.

Real-Life Example: Investing in European Dividend Aristocrats

When Sarah, a young investor, wanted to build a stable portfolio with consistent income, she turned to European Dividend Aristocrats. She researched companies with a strong history of dividend growth and found that many of them were based in countries like Germany, France, and the United Kingdom. After carefully reviewing the European Dividend Aristocrats list, she decided to invest in an ETF that tracked these companies.

Sarah’s decision to invest in European Dividend Aristocrats proved fruitful as she enjoyed not only regular dividend payments but also saw potential for long-term growth in her investment. This real-life example demonstrates how investing in European Dividend Aristocrats can be a strategic move for investors seeking both income and stability in their portfolio.

Belgium

Belgium may be small, but its Dividend Aristocrats pack a punch. Companies like Ageas, an insurance group, have been rewarding shareholders without fail, reflecting the stable nature of the Belgian market.

Denmark

Denmark’s Novo Nordisk has been a diabetic’s best friend and a dividend investor’s delight, showcasing the robust nature of the healthcare sector in this Nordic nation.

Finland

Finland, with its small but mighty economy, presents companies like KONE Corporation, which have been elevating their dividend game as smoothly as their renowned elevators ascend skyscrapers.

France

France is not just about fine wine and fashion; it’s also home to dividend stalwarts like L’Oréal. The beauty giant’s dividends are as consistent as its products are popular, proving that luxury and dividends can go hand-in-hand.

Germany

Germany’s economic engine is fueled by Dividend Aristocrats such as BASF. The chemical giant has a formula not only for innovative products but also for consistent shareholder rewards.

Ireland

Casting a glance towards Ireland, one cannot overlook the dividends flowing from the likes of CRH plc. The building materials group has laid a solid foundation for dividend growth year after year.

Italy

Italy’s Enel has been powering dividends as reliably as it does homes, highlighting the strength of utility companies in the dividend domain.

Netherlands

From the Netherlands, Unilever stands out with a dividend history as rich as its product portfolio. The consumer goods behemoth is a testament to the Dutch tradition of trading and wealth generation.

Norway

Norway’s Equinor, an energy company, illuminates the dividend scene with its commitment to shareholders, much like the country’s philosophy of sustainable wealth management.

Portugal

Jerónimo Martins, a Portuguese retail giant, bags groceries and dividends with equal finesse, showing that even in smaller markets, there are dividend kings.

Spain

Spain’s Banco Santander waves the dividend flag high in the banking sector, a reminder that even in the tumultuous world of finance, there are beacons of consistency.

Sweden

Sweden’s dividend royalty is personified by companies like Atlas Copco, which have been engineering dividends with the same precision as their world-renowned industrial machinery.

Switzerland

Switzerland, known for its financial prowess, does not disappoint with Dividend Aristocrats like Nestlé. The food and drinks leader’s dividends are as palatable as its products.

United Kingdom

The UK boasts a royal guard of Dividend Aristocrats, with companies like Diageo serving up dividends as smoothly as their premium spirits.

European Dividend Aristocrats ETFs

For those who prefer a hands-off approach to investing in European Dividend Aristocrats, ETFs are your knights in shining armor. These funds aggregate the might of dividend-paying companies, providing an easy route to owning a slice of the aristocracy.

One such ETF, Vanguard’s Dividend Aristocrats ETF, is a popular choice. It’s a veritable buffet of dividend goodness, offering exposure to a wide array of European companies with stellar dividend records.

For a deeper dive into how to pick the best ETFs, here’s a resource that can help.

Insider Tip:

Diversify your holdings with ETFs that focus on different sectors and regions to mitigate risks and capitalize on global dividend opportunities.

In conclusion, the European Dividend Aristocrats are not just a list or an investing strategy; they’re a financial philosophy. They exemplify the power of compounding, the resilience of well-established firms, and the allure of passive income. Whether you’re sipping espresso in a Roman café or crunching numbers in a Scandinavian office, these aristocratic dividends can be the cornerstone of a robust investment portfolio. So, tip your hat to the European Dividend Aristocrats, for they are the guardians of the dividend realm, and with them, your portfolio is just a little more regal.

Frequently Asked Questions

What are European Dividend Aristocrats?

European Dividend Aristocrats are companies with a history of increasing dividends for at least 10 consecutive years.

Who can invest in European Dividend Aristocrats?

Any investor with access to European stock markets can invest in European Dividend Aristocrats through various financial instruments.

How can I identify European Dividend Aristocrats?

You can identify European Dividend Aristocrats by using stock screeners that filter for companies with a consistent dividend growth history.

What if I’m concerned about market volatility?

European Dividend Aristocrats are known for their stability and ability to weather market volatility due to their strong dividend track record.

How can I benefit from European Dividend Aristocrats?

Investing in European Dividend Aristocrats can provide a steady stream of passive income through reliable dividend payments.

What if I’m new to investing in European stocks?

If you’re new to investing in European stocks, consider consulting with a financial advisor to discuss the potential benefits and risks.