Global Dividend Aristocrats don’t just wear crowns in the financial kingdom; they are the blue-blooded royalty of the stock market, proving their worth time and again through consistent dividend increases. These aren’t your ordinary stocks; they are a testament to reliability and endurance in a world where financial climates fluctuate more than a politician’s promises.

As an investor who used to be chained to the volatile swings of high-growth tech stocks, I learned the hard way that sometimes the tortoise really does beat the hare. Now, let’s dive into the realm of Global Dividend Aristocrats, where stability reigns supreme, and growth, though slower, is as steady as the march of time itself.

Learn About Global Dividend Aristocrats

In this article, you will learn:

- Definition and significance of global dividend aristocrats

- Mechanism and benefits of global dividend aristocrats

- Ways to invest in global dividend aristocrats

What Are Global Dividend Aristocrats?

Imagine a lineage of stocks, each with a track record of increasing dividends for at least a decade. These are the Global Dividend Aristocrats, the upper echelon of dividend-paying companies that span across the globe. They are not limited by geography, operating in various industries, yet they share a common trait: a staunch commitment to returning value to shareholders.

In my early days of investing, I stumbled upon a company that had increased its dividend for over 25 consecutive years. I was intrigued, not by the mere increase but by the unwavering commitment through economic upheavals. This company was my introduction to the world of Dividend Aristocrat shares.

Historically, these stocks have been less volatile than the broader market, providing a smoother ride for investors like myself, who once clung to the rollercoaster of short-term trading. As I shifted my focus to long-term wealth building, these aristocrats became the cornerstone of my investment portfolio.

How Do Global Dividend Aristocrats Work?

Global Dividend Aristocrats operate on a simple yet powerful principle: they prioritize shareholder returns. This commitment to dividends isn’t just for show. It’s a disciplined strategy that requires careful financial management, ensuring that the company generates sufficient cash flow to support these increasing payouts year after year.

For an aristocrat dividend stock to be considered a Global Dividend Aristocrat, it must not only increase dividends but do so in various economic conditions. This indicates a resilient business model capable of adapting to changing market dynamicsa quality that is not merely desirable but essential for any company I entrust with my hard-earned money.

Insider Tip: When evaluating a potential Global Dividend Aristocrat, scrutinize beyond the dividend yield. Examine the payout ratio, the percentage of earnings paid as dividends. A sustainable payout ratio signals a company’s ability to continue its aristocratic legacy without compromising its financial health.

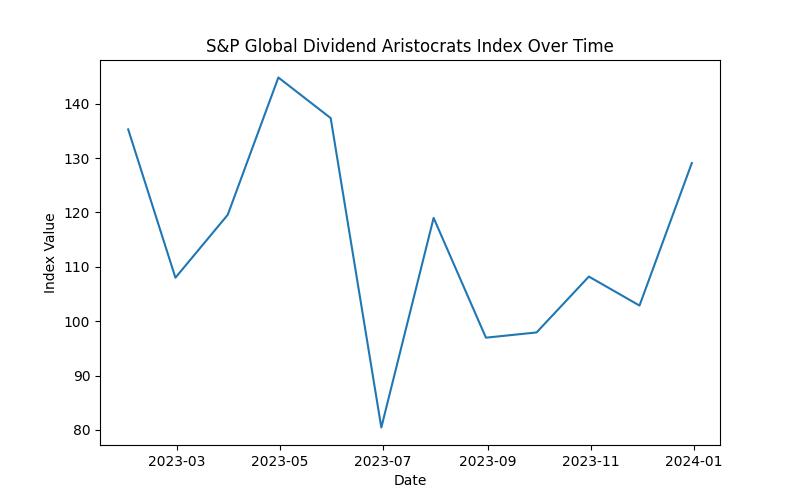

For those interested in the statistical rigor behind these stocks, consider the S&P Global Dividend Aristocrats Index, which tracks the performance of high-yielding companies that have managed to increase dividends every year for at least ten years. This is the playground where fiscal resilience meets investor opportunity.

How to Invest in Global Dividend Aristocrats

Investing in Global Dividend Aristocrats isn’t just about picking stocks; it’s about adopting an investment philosophy. It’s about recognizing the value in companies that have stood the test of time and are likely to continue doing so.

For me, the journey began with individual stocks, meticulously researching each company’s history of dividend payments and assessing its future prospects. Over time, I diversified my approach by incorporating exchange-traded funds (ETFs) like Vanguard’s Dividend Aristocrats ETF, which captures the essence of this strategy in a single, manageable investment.

The allure of Global Dividend Aristocrats lies in their simplicity. They are a set-it-and-forget-it addition to any portfolio, ideal for investors seeking to build an income stream that has the potential to grow over time. Whether you’re a seasoned investor or just starting, these stocks can serve as the bedrock of a diversified investment strategy.

Pros and Cons of Global Dividend Aristocrats

As with any investment, Global Dividend Aristocrats come with their own set of advantages and drawbacks. The pros are straightforward: stability, consistent income, and a tendency to outperform the broader market during downturns. This trifecta of benefits is what drew me in after experiencing the whiplash of tech stocks in a down market.

On the flip side, the cons are worth noting. These stocks typically don’t offer the meteoric growth potential of their more volatile counterparts. For investors thirsting for rapid gains, Global Dividend Aristocrats might not quench that desire. Furthermore, heavy reliance on past dividend performance doesn’t guarantee future results, particularly in an unpredictable global economy.

Insider Tip: Look for Global Dividend Aristocrats with a history of manageable debt levels and robust free cash flow. This financial footing can provide a buffer against market adversity and support ongoing dividend growth.

Despite these cons, I’ve found a sense of financial serenity in these stocks. They might not be the sprinters of the investment world, but they are certainly the marathon runners, pacing themselves for a race that knows no finish line.

The Benefits of Investing in Global Dividend Aristocrats

I first learned about the concept of global dividend aristocrats from a close friend who had been successfully investing in them for several years. Sarah, a savvy investor, explained to me how these companies have a strong track record of consistently increasing their dividend payments, making them a reliable source of passive income.

Sarah’s Success Story

Sarah shared her experience of investing in a global dividend aristocrats list, citing how she had enjoyed regular dividend payments even during market downturns. She explained that these companies have a proven ability to weather economic instability, making them a valuable addition to her investment portfolio.

Investing in global dividend aristocrats not only provided Sarah with a steady stream of income but also offered the potential for long-term capital appreciation. Witnessing Sarah’s success firsthand inspired me to delve deeper into this investment opportunity.

By following Sarah’s lead and incorporating global dividend aristocrats into my investment strategy, I have been able to achieve a diverse portfolio that generates consistent returns, regardless of market fluctuations.

The Bottom Line

Global Dividend Aristocrats aren’t just a collection of stocks; they’re a symbol of financial fortitude, a beacon for investors navigating the often tumultuous seas of the stock market. Their appeal lies not in the thrill of the chase but in the quiet confidence of sustained growth and reliability.

For me, embracing Global Dividend Aristocrats was less about chasing yields and more about finding peace in my investment journey. It was about transitioning from the frenetic energy of day trading to the cultivated calm of dividend growth investing. These stocks aren’t just a financial strategy; they’re a lifestyle choice, a choice that prioritizes stability over speculation, substance over sizzle.

In the end, whether you’re drawn to the allure of Global Dividend Aristocrats for their dependable income, their historical resilience, or simply the elegance of their investment thesis, they offer a compelling case for inclusion in any well-rounded portfolio. After years of investing in these financial stalwarts, I’ve learned that sometimes, the most profound wealth is found not in the coins that clink but in the dividends that consistently click upwards, year after year.

Questions and Answers

Who are global dividend aristocrats?

Global dividend aristocrats are companies with a history of consistently increasing dividends.

What is the significance of global dividend aristocrats?

They offer investors stable income and potential for long-term growth.

How can I invest in global dividend aristocrats?

You can invest in them through exchange-traded funds (ETFs) that track dividend aristocrat indexes.

What if I am concerned about market volatility?

Global dividend aristocrats have a history of weathering market downturns and providing reliable income.

How do global dividend aristocrats differ from other stocks?

They prioritize consistent dividend payments and have a track record of financial stability.

What if I am interested in a specific industry?

There are global dividend aristocrat ETFs that focus on specific sectors, allowing you to target your investments.

Leave a Reply