You’ve likely heard the saying, ‘Don’t put all your eggs in one basket.’ When it comes to investments, understanding dividend yield essentials is like diversifying your financial territory.

By grasping the significance of dividend yield in relation to overall returns, you open doors to a territory where strategic insights can shape your investment portfolio.

But how exactly does dividend yield play a pivotal role in maximizing returns? Let’s explore the fundamental principles that can guide you towards a more profitable investment journey.

What Is Dividend Yield?

Do you know what dividend yield represents?

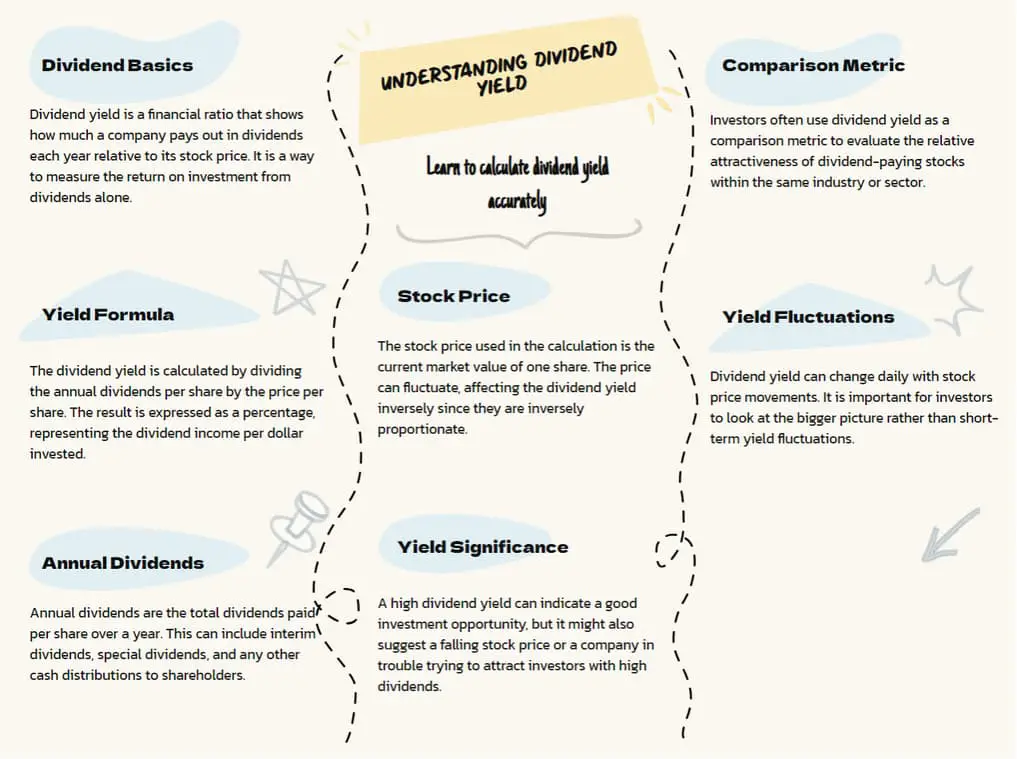

Dividend yield is a critical financial metric for investors, indicating the percentage of a company’s annual dividend payment in relation to its stock price. By calculating dividend yield, investors can gauge the returns they might expect from their investment in the form of dividends.

A good dividend yield, typically considered to be 3% or higher, can signify attractive investment opportunities. This metric not only helps in evaluating the income potential but also provides insights into the financial health of a company.

Understanding dividend yield is fundamental for investors as it aids in evaluating different investment options and making well-informed decisions. By analyzing dividend yield, investors can better comprehend the income-generating capabilities of a stock and make comparisons between various companies.

Ultimately, dividend yield serves as a valuable tool for investors seeking to maximize their returns while maintaining a balanced investment portfolio.

Calculating Dividend Yield

To calculate dividend yield accurately, divide the annual dividend per share by the stock price per share. This calculation provides a vital metric for evaluating the income potential of a stock investment.

By comparing dividend yields among different companies, investors gain valuable insights into their dividend-paying ability. Keep in mind that dividend yield isn’t static; it can fluctuate due to changes in both stock price and dividend payouts.

Understanding the method for calculating dividend yield is fundamental for making informed investment decisions. By mastering this calculation, you can maximize returns on your investments.

Paying attention to dividend yield allows you to evaluate the efficiency of a stock in generating income for its shareholders. Stay informed about fluctuations in stock prices and dividend payouts to make strategic investment choices that align with your financial goals.

Calculating dividend yield empowers you to make sound investment decisions and optimize your portfolio for growth.

Importance of Dividend Yield

Understanding the importance of dividend yield is key for evaluating the income potential and investment opportunities presented by different companies.

Dividend yield provides insight into how much a company pays out in dividends relative to its stock price. By calculating dividend yield, investors can assess the financial stability and profitability of potential investments.

A good dividend yield, typically 3% or higher, indicates a company’s commitment to returning value to its shareholders. High dividend yield stocks not only offer a reliable income stream but also can act as a cushion during market fluctuations.

Investors often seek companies with consistent or increasing dividend payouts, as it shows the financial strength and management’s confidence in the business.

Evaluating dividend yield alongside other financial metrics can help you make informed decisions about where to allocate your investment funds. Keep in mind that dividend yield is just one aspect when building a diversified investment portfolio that aligns with your financial goals.

Understanding Adjusted Returns

Factor in dividends and stock price changes to gain a more accurate understanding of investment performance with adjusted returns. Adjusted returns provide a vital analysis by considering the impact of dividends on overall returns. This calculation takes into account external factors such as inflation and taxes, offering a more detailed perspective on investment outcomes.

By factoring in dividend income and stock price fluctuations, adjusted returns give investors a clearer picture of their actual gains. Understanding adjusted returns is essential for making informed investment decisions that maximize returns effectively. It allows you to assess the true value of your investments by accounting for all relevant variables.

With this knowledge, you can navigate market fluctuations and make strategic choices that align with your financial goals. Incorporating adjusted returns into your investment analysis empowers you to make decisions based on a more complete understanding of your portfolio’s performance.

Maximizing Returns With Dividend Yield

Considering the impact of dividend yield is pivotal in optimizing your investment returns effectively and strategically. High dividend yields from companies can provide a steady income stream and potentially shield your investments during market volatility. To maximize returns, it’s crucial to calculate dividend yield by dividing the annual dividend per share by the stock price per share.

This metric allows you to assess the income generated relative to the investment cost. Adjusted returns take into account both dividends and stock price appreciation, offering a more complete view of your investment performance.

When aiming to align your investments with your personal financial goals, incorporating dividend yield for decision-making is vital. By selecting stocks with attractive dividend yields that fit your investment objectives, you can work towards maximizing your returns over time. Understanding the significance of dividend yield essentials empowers you to make informed choices that support your financial growth and aspirations.

Frequently Asked Questions

How Do Fluctuations in Interest Rates Impact Dividend Yields?

Fluctuations in interest rates directly impact dividend yields. Rising rates can lower stock prices and yield attractiveness. Companies adjust payouts to maintain value. Low rates increase demand for high-yield stocks. Understand this link for better investment decisions.

Can Dividends Be Reinvested Automatically to Maximize Returns?

Yes, dividends can be automatically reinvested to maximize returns. By utilizing Dividend Reinvestment Plans (DRIPs), you can compound your investment growth over time. This strategy can lead to increased wealth accumulation and higher overall returns.

Are There Specific Industries or Sectors That Tend to Offer Higher Dividend Yields?

In industries like real estate, utilities, consumer staples, energy, and finance, you’ll find higher dividend yields. These sectors excel in distributing profits to shareholders, making them attractive for those seeking increased returns through dividends.

How Does a Company’s Dividend Payout Ratio Affect Its Long-Term Sustainability?

To guarantee long-term sustainability, monitor a company’s dividend payout ratio closely. A lower ratio allows reinvestment for growth and resilience. High ratios may hinder operations and resilience. Understanding this metric is key for gauging financial health.

What Are Some Common Pitfalls to Avoid When Relying on Dividend Yields for Investment Decisions?

When relying on dividend yields for investment decisions, avoid high yields signaling financial distress, fluctuating yields, unsustainable high yields leading to cuts, and neglecting earnings growth and payout ratio analysis. Make stability before investing.