Tap into the robust S&P 500 Dividend to access top American corporations and secure a steady stream of passive income. Benefit from stable companies and firms with a track record of increasing dividends annually. Consider dividend aristocrats for reliability and implement strategies like DRIP for growth. Diversify your portfolio to reduce risks, focusing on companies with proven records. Explore historical performance, tax factors, and the potential for building a diversified dividend portfolio across sectors. Discover the vast potential of America’s corporate giants through S&P 500 Dividend.

Overview of S&P 500 Dividend

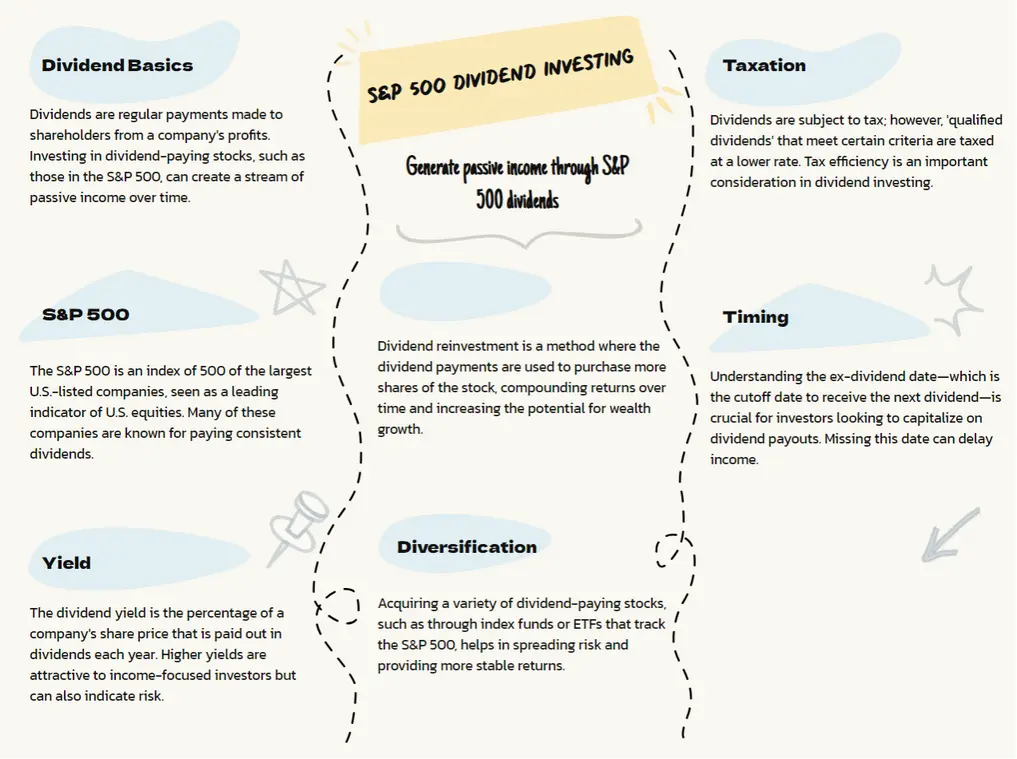

The S&P 500 Dividend index offers income-seeking investors exposure to high-quality dividend-paying stocks, including companies known as Dividend Aristocrats. These Dividend Aristocrats are firms within the S&P 500 index that have a consistent track record of increasing dividends for at least 25 consecutive years. By investing in the S&P 500 Dividend, you gain access to these reputable companies that have demonstrated their commitment to rewarding shareholders through regular dividend payments and potential for growth.

These Dividend Aristocrats represent some of the most stable and reliable companies in the market, making them attractive options for investors seeking a combination of income and stability in their portfolios.

The S&P 500 Dividend index strategically selects these companies to provide a blend of dividend yield and growth opportunities, offering you a well-rounded investment choice that taps into the strength of American corporate giants. Investing in Dividend Aristocrats through the S&P 500 Dividend index can be a smart move for those looking to benefit from the long-term success and stability of these esteemed companies.

Benefits of Investing in S&P 500 Dividend

Experiencing the steady income flow from investing in S&P 500 Dividend can bolster your financial stability and growth potential. By tapping into the world of Dividend Stocks, you gain access to a diverse range of top American corporations renowned for their consistent dividend payments. These companies offer a reliable stream of passive income, ideal for investors seeking stable returns in their portfolios.

One notable advantage of investing in S&P 500 Dividend is the track record these companies hold for increasing dividends annually. This showcases their financial strength and commitment to rewarding shareholders. Additionally, dividend payments from these companies have the potential to greatly enhance your total returns over time, ultimately improving your portfolio performance.

Furthermore, the S&P 500 Dividend index comprises high-quality companies known for their resilience and stability in dividend payouts. By investing in these reputable firms, you not only secure a reliable income source but also position yourself for long-term financial success.

| Benefits of Investing in S&P 500 Dividend | |

|---|---|

| Diverse Range of Top American Corporations | Reliable Stream of Passive Income |

| Track Record of Increasing Dividends Annually | Enhanced Portfolio Performance |

| Resilient and Stable Dividend Payouts | Long-Term Financial Success |

Understanding Dividend Aristocrats

When it comes to understanding Dividend Aristocrats, it’s important to recognize their impressive track record of consistently increasing dividends for over 25 years.

By prioritizing dividend growth, these companies showcase their dedication to rewarding shareholders and providing long-term value.

Investors often find comfort in the stability and reliability that Dividend Aristocrats offer, making them a favored choice for those seeking passive income opportunities.

Aristocrats Dividend Track Record

With a history of 25 consecutive years or more of increasing dividends, Dividend Aristocrats showcase an impressive track record of financial stability and shareholder rewards. These elite S&P 500 companies have consistently demonstrated their commitment to rewarding investors through a disciplined approach to growing dividends year after year. Their ability to adapt to changing market conditions while maintaining a steady dividend payout makes them stand out in the domain of income-seeking investments.

The track record of Dividend Aristocrats speaks volumes about their resilience and ability to generate long-term value for shareholders. By investing in these companies, you gain access to a proven strategy that has historically outperformed the broader market, providing you with a reliable source of passive income and potential capital appreciation.

Benefits of Dividend Growth

To fully comprehend the ‘Benefits of Dividend Growth‘ and gain insight into Understanding Dividend Aristocrats, examining their consistent track record of increasing dividends annually is essential. Dividend Aristocrats, comprising S&P 500 companies that have raised dividends for a minimum of 25 consecutive years, showcase financial stability and disciplined management practices. Investing in these companies offers numerous advantages, including the potential for long-term outperformance compared to the broader market.

Top Dividend-Paying Stocks in S&P 500

Among the top dividend-paying stocks in the S&P 500, Pfizer Inc. (PFE) stands out with a market value of $152 billion and a dividend yield of 6.3%, boasting a long history of over 85 years of dividend payments.

3M Co. (MMM) follows closely behind with a market value of $50 billion and a dividend yield of 6.5%, although its future dividend yield is uncertain due to ongoing reorganization.

Altria Group Inc. (MO) commands attention with a market value of $67 billion and the highest dividend yield of 9.6% among the top stocks, thanks to its dominance in the U.S. tobacco market and stable operations.

Healthpeak Properties Inc. (PEAK) offers a dividend yield of 7.4% with a market value of $18 billion, focusing on healthcare real estate and maintaining stable dividend payouts.

Verizon Communications Inc. (VZ) rounds out the list with a market value of $208 billion and a dividend yield of 6.7%, known for its consistent performance in the telecommunications industry.

These dividend yields reflect the companies’ commitment to rewarding investors while maneuvering their respective market landscapes.

Strategies for Maximizing Dividend Returns

Consider compounding your dividend returns by implementing a dividend reinvestment plan (DRIP). This strategy allows you to automatically reinvest your dividends back into the stock that paid them, leading to a snowball effect of compounded growth over time.

To further maximize your dividend returns, focus on companies with a proven track record of consistent dividend growth. These companies often demonstrate strong financial health and a commitment to rewarding their shareholders.

Additionally, investing in dividend aristocrats, which are S&P 500 companies with at least 25 years of consecutive dividend increases, can provide you with a reliable source of income and potential for capital appreciation.

Diversifying your dividend portfolio across various sectors can help reduce risk and enhance stability, ensuring that you aren’t overly exposed to any single industry’s performance.

Risks Associated With S&P 500 Dividend

Investing in S&P 500 dividend stocks exposes investors to market risks stemming from fluctuating stock prices. The table below outlines key risks associated with S&P 500 dividends that investors should consider:

| Risk | Description | Example |

|---|---|---|

| Dividend Cuts or Suspensions | Companies reducing or halting dividend payments impact investor income streams. | XYZ Corp cutting dividends by 50% due to financial challenges. |

| Economic Downturns | Downturns can lower corporate profits, affecting dividend payouts from S&P 500 companies. | Decreased consumer spending leading to reduced company earnings. |

| Interest Rate Changes | Fluctuations in interest rates can alter the attractiveness of dividend-paying stocks in the S&P 500. | Increase in rates making bonds more appealing than dividend stocks. |

Understanding these risks is essential for managing an S&P 500 dividend portfolio effectively. By analyzing sector-specific risks within the S&P 500, investors can make informed decisions to navigate potential challenges and optimize their dividend returns.

Historical Performance of S&P 500 Dividend

When examining the performance of S&P 500 Dividend Index over the years, remarkable trends emerge that showcase its consistent growth and resilience. Here are three key points to take into account:

- Annualized Return: The S&P 500 Dividend Index has delivered an impressive annualized return of 11.94% since 2010, surpassing the broader S&P 500 index. This growth rate highlights the index’s ability to generate substantial returns for investors seeking income.

- Dividend Growth Rate: From 2010 to 2022, the S&P 500 Dividend Index exhibited a high annualized dividend growth rate of 13.8%, outpacing the long-term U.S. inflation rate. This consistent growth in dividends underscores the index’s commitment to providing investors with a reliable income stream.

- Defensive Characteristics: With a downside capture ratio of 94.5%, the index demonstrates defensive characteristics that make it attractive to income-seeking investors. These qualities add an element of stability and resilience to the index, further reinforcing its appeal for those looking to tap into the power of American corporations.

Tax Implications of S&P 500 Dividend

When investing in the S&P 500, understanding the tax implications of dividends is key. Different tax rates apply depending on the type of dividend you receive.

Qualified dividends are taxed at lower rates, benefiting long-term investors, while non-qualified dividends face higher ordinary income tax rates.

Tax Rates on Dividends

Tax rates on dividends from S&P 500 companies vary based on individual income levels, with qualified dividends subject to lower capital gains tax rates. When considering the tax implications of S&P 500 dividends, understanding how these rates can impact your overall investment strategy is crucial. Here are three key points to keep in mind:

- Varied Tax Rates: Individual income tax rates ranging from 0% to 37% apply to dividends based on your income level.

- Qualified Dividends: Enjoy lower capital gains tax rates of 0%, 15%, or 20% on qualified dividends from S&P 500 companies.

- Non-Qualified Dividends: Non-qualified dividends are taxed at ordinary income tax rates, potentially higher than those for qualified dividends.

Qualified Dividend Requirements

To fully benefit from the lower capital gains tax rates on qualified dividends from S&P 500 companies, make sure that you meet the specific requirements for dividend qualification. These requirements include dividends being paid by U.S. corporations or qualified foreign corporations. Additionally, there are holding period requirements that must be satisfied for dividends to be considered qualified.

By understanding and adhering to the criteria for qualified dividends, investors can enjoy tax advantages over ordinary dividends. This understanding is essential for optimizing tax efficiency in investment portfolios, as it allows eligible investors to make informed decisions that can positively impact their overall returns.

Stay informed about the dividend qualification criteria to make the most of the tax benefits available to you.

Comparing S&P 500 Dividend ETFs

For investors evaluating S&P 500 Dividend ETFs, comparing their performance against traditional index funds can provide valuable insights into income potential. When examining these ETFs, consider the following:

- Yield Strength: S&P 500 Dividend ETFs focus on high dividend-yielding companies within the index, offering a potential for attractive income streams.

- Historical Performance: Reviewing the historical performance of S&P 500 Dividend ETFs can give you a sense of how these funds have fared in different market conditions, providing a basis for comparison.

- Expense Ratios: Understanding the expense ratios associated with different S&P 500 Dividend ETFs is essential for maximizing returns, as lower expenses can have a significant impact on your overall gains over time.

Building a Diversified Dividend Portfolio

When considering the construction of your diversified dividend portfolio, focus on including a range of companies that offer consistent income potential and growth opportunities. Diversifying across various sectors and industries helps mitigate risk and enhances the potential for long-term returns. Aim to include companies with different market capitalizations, dividend yields, and growth prospects to achieve a well-rounded portfolio. Below is a table illustrating a hypothetical diversified dividend portfolio:

| Company | Market Capitalization | Dividend Yield |

|---|---|---|

| Tech Giant A | Large | 3.5% |

| Pharma Company B | Mid | 2.8% |

| Utility Firm C | Small | 4.2% |

Future Outlook for S&P 500 Dividend

Looking ahead at the future outlook for the S&P 500 Dividend will involve analyzing growth potential, sector diversification impact, and economic environment influence. Understanding how these factors interplay can help you make informed decisions about your investment strategy.

Growth Potential Analysis

With a track record of consistent dividend payments and robust performance, the S&P 500 Dividend index showcases promising growth potential for income-focused investors.

Here are three key points to contemplate:

- High Yield Focus: The index emphasizes high yield companies within the S&P 500, catering to investors seeking substantial income streams.

- Consistent Dividend Growth: Constituents are selected based on their history of consistent and increasing dividend payments over the last five years, indicating stability and potential for future growth.

- Outperformance: Showing an annualized return of 11.94% since 2010, the index has outperformed the S&P 500, making it an attractive option for those looking for both income and growth opportunities.

Sector Diversification Impact

The impact of sector diversification in the S&P 500 Dividend index shapes its future outlook by spreading risk and enhancing stability across various industries. By allocating investments across different sectors, the index reduces concentration risk, providing a more balanced income stream for investors.

This diversification strategy helps mitigate potential losses from underperforming sectors, ultimately contributing to a more stable dividend yield over time. Sector weights within the index are adjusted based on market conditions and individual sector performance, ensuring a dynamic allocation of resources.

Investors benefit from this diversified approach as it allows them to tap into the free cash flow potential of a wide range of industries, creating a robust income portfolio that can weather market fluctuations effectively.

Economic Environment Influence

Influenced by prevailing economic conditions and corporate performance, the future trajectory of S&P 500 dividends hinges heavily on a complex interplay of various factors. When considering the economic environment’s impact on dividend payments, it’s vital to focus on specific aspects:

- Interest Rates: Fluctuations in interest rates can influence investment decisions and ultimately affect companies’ ability to sustain or increase dividend payouts.

- Inflation: Rising inflation can erode purchasing power, impacting consumer spending and corporate profitability, consequently affecting dividend payments.

- GDP Growth: The overall economic growth rate plays an important role in determining the financial health of corporations, influencing their capacity to allocate funds towards dividend distributions.

Stay vigilant on these economic indicators to gauge the future direction of S&P 500 dividend payments.

Frequently Asked Questions

What Is the Highest Dividend Paying Company in the S&P 500?

Altria Group Inc. offers the highest dividend yield in the S&P 500 at 9.6%. With stable operations and a dominating presence in the U.S. tobacco market, it’s a top choice for income-seeking investors looking for consistent returns.

How Much Does the S&P 500 Pay in Dividends?

The S&P 500 pays dividends based on company performance and market conditions. In 2021, you could have received about $58.28 per share. Tracking these yields helps you gauge potential income from the index’s powerhouse corporations.

What Are the 5 Highest Dividend Paying Stocks?

To find the 5 highest dividend-paying stocks, you should look into companies like Pfizer, Devon Energy, Whirlpool, 3M, and Kinder Morgan. These offer attractive yields ranging from 6.3% to 6.6%, with Altria Group leading at 9.6%.

What Percentage of S&P 500 Return Is From Dividends?

Dividends historically contribute about one-third of the S&P 500 return. They play an important role in total return, offering stability and growth potential. Understanding this key aspect can enhance your investment strategy and overall success.

Conclusion

To wrap up, investing in S&P 500 Dividend offers a stable and reliable way to tap into the powerhouse of American corporations. By understanding dividend aristocrats, choosing top dividend-paying stocks, and implementing strategies for maximizing returns, you can build a diversified portfolio with the potential for long-term growth.

Consider the tax implications and compare S&P 500 Dividend ETFs to make informed decisions for your financial future. Stay informed and proactive to make the most of this lucrative investment opportunity.